Two-Party Escrow

When buying from or selling to strangers online, you need to be confident that the other party will keep their end of the agreement and not scam you. That’s why contract security and enforcement are essential when trading goods and services in any marketplace.

To guarantee your security in any given marketplace transaction, Particl Marketplace requires you to use its unique and no-cost two-party escrow system.

Typical Resolution Centers

When two parties (a buyer and a seller) transact in a marketplace, a third-party (the escrow agent) usually holds the payment and releases it when the transaction is completed (i.e., the purchased item is delivered). That role is generally assumed by the marketplace itself (i.e., Amazon), a payment processor (i.e., Paypal, Visa), or third-party escrow services (i.e., a bank or a financial institution).

This allows any potential dispute or issue to be settled in the simplest way, but it also has downsides both parties need to be aware of.

High Escrow Fees

No service is ever provided for free. Because there are massive underlying costs to running escrow services, they are provided at a sizable cost. That’s because escrow service providers need to hire staff, deploy secure systems, define and enforce policies, pay for never-ending legal fees, assume fraud risk, etc.

In some cases, marketplaces will clearly indicate the cost of securing a transaction with escrow or resolution services. In other cases, this cost is not independently displayed but instead included in the total transaction fee.

Skewed Resolutions

When an issue arises, it is usually settled following a very rigid set of policies rather than being dealt with on a case-by-case basis. This allows a greater number of issues to be resolved quickly and efficiently, but it also leads to skewed resolutions.

As a logical business standard, marketplaces and payment processors will typically side with buyers instead of sellers because it carries fewer risks of losing business that way.

Online merchants are well aware of this bias and must reduce their exposure to this risk through their prices.

Fraud, Scams, and Abuse

Knowing issue resolution policies tend to be rigid, online scammers have perfected the art of abusing them and tricking escrow systems and agents. Even on very popular platforms like Amazon or Paypal, escrow and return scams are rampant, leading to thousands of dollars being stolen from sellers every day, not counting the environmental impact associated with product return scams.

One of the best examples of an escrow scam is the infamous but prominent “return scam” on eBay. Let’s say you put up an item, typically used, worth $1,000 for sale online. The scammer will buy it from you, pay for the item, and wait to receive it. Once received, he will claim it isn’t as advertised, typically claiming the object is damaged, and request a refund. The refund request requires them to ship back the item in the same package, which is what they do. But instead of putting your item back into the box, they’ll substitute the purchased items with scraps weighing the same as the initial item. This is often enough to trick the automated process used by eBay, granting them the refund and leaving the seller at a loss.

Intrusive Data Requirements

To resolve a dispute, escrow services need to know as much as they can about you and the party you’re transacting with. Of course, all of this information is stored on one or more central databases for further reference and monetization.

This is an obvious case of storing too much data, leading to countless data breaches and leaks every year. The more data a company collects about its users, the bigger the target it becomes for hackers and abusers.

No Privacy at All

When using an escrow service, you and the other party you’re transacting with both need to trust the escrow agent in full. That’s because you are granting that party full access to a lot of sensitive information about you and the right to hold money on your behalf.

The amount of data provided to escrow agents gives them complete oversight of all the personal, professional, and financial data generated by your use of the platform.

Particl’s Open Marketplace solves this problem without the need for a third party.

Particl’s Unique Solution

Particl adopts a radically different escrow model that fixes all of these issues. Dubbed a “two-party escrow system”, it only involves two parties: the buyer and the seller.

Instead of requiring a third-party to hold the payment on behalf of two transacting parties, both participants are required to provide collateral by committing an equal security deposit into a smart contract. This security deposit is automatically refunded to both parties, in its entirety, once both parties mark the transaction as completed.

If any dispute or issue arises, both parties need to mutually agree on a satisfying resolution for both of them to mark the transaction as complete. Because the two parties have a security deposit locked into the escrow smart contract, they are naturally forced to collaborate and reach a reasonable resolution for both. Failure to reach an agreement will keep both security deposits locked until a resolution is agreed upon.

Benefits

Particl’s novel approach to securing online trades comes with many benefits not possible otherwise when using traditional e-commerce platforms and escrow models.

It’s Free (No Fees)

Particl’s two-party escrow system is entirely free to use. There is no additional cost or percentage taken off transactions other than the regular cryptocurrency transaction fee, which is usually just a few cents or sometimes even less than that.

Stay in Control

You and the other party you’re transacting with are in total control of the process. There is no third-party involved in the transaction who can force a resolution against the will of a participant.

Maximum Data Security

Particl’s two-party escrow system doesn’t generate any extra data. If no data is generated first, it can’t be collected by anyone else. The system works autonomously using the power of :term:`smart contract <smart contract>`s and privacy-first blockchain technology.

Complete and Total Privacy

Since two-party escrows don’t require the intervention of a third-party, personal information (i.e., shipping details) is only made available to the other person you’re transacting with. And because of the naturally encrypted nature of Particl’s online escrow system, nobody other than a transaction’s participants can know anything about it.

Considerations

Each escrow transaction requires an equal security deposit as collateral from both the seller and the buyer

Security deposits are equal to an agreed-upon percentage of the value of the transaction.

The PART coin’s price can vary while a payment is locked in escrow. That means you may not end up with the exact same fiat (i.e., USD, EUR, etc.) value that you initially put as a security deposit based on trading activities during that time.

How it Works

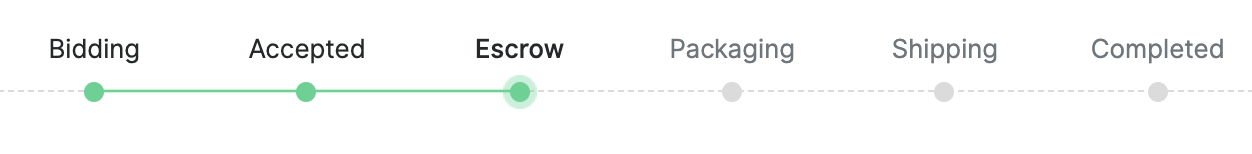

Using Particl’s two-party escrow system is a step-by-step process that requires a few manual inputs from you. The complete flow of a single transaction, from the moment an order is placed to when the transaction is completed, is as follows.

ORDER REQUEST: The buyer places an order request and waits for the seller to accept it.

ACCEPTED: The seller accepts the bid and now waits for the buyer to send their payment and security deposit into the escrow smart contract.

ESCROW: The buyer sends their payment and security deposit into the escrow smart contract and now waits for the seller to send their security deposit as well.

PACKAGING: The seller has made their security deposit into the escrow smart contract and is now packaging the order to ship it.

SHIPPING: The seller has shipped the item as shipped and is now waiting for the buyer to receive and confirm the delivery.

COMPLETE: The item has been received by the buyer. The item has been inspected, and no issue was found. Therefore, the buyer has marked the transaction as complete. There are no more required actions in this transaction. Both participants have received their security deposits back, and the seller has received the full payment for the purchased item.

Understanding the Game Theory Behind

To understand why Particl’s two-party escrow system is effective, it’s essential to understand the mathematical principles on which it relies. The Particl Marketplace’s escrow system is loosely based on “game theory”.

By definition, game theory simply refers to the study of mathematical models of strategic interaction among rational decision-makers. In other words, how can rational decision-making be rewarded and irrational/dishonest behavior be punished simultaneously?

To accomplish that, Particl leverages the Mutually Assured Destruction (MAD) game theory and gives it a financial twist. “MAD” is a military doctrine “based on the theory of deterrence, which stipulates that the threat of using strong weapons against the enemy prevents the enemy’s use of those same weapons. The strategy is a form of Nash equilibrium in which, once armed, neither side has any incentive to initiate a conflict or to disarm” (Wikipedia).

Simply put, when two countries are armed with, for example, nuclear weapons, there is no incentive for any of them to attack each other as that would inevitably result in an equally destructive retaliation. This would, ultimately, leave both countries in rumbles and make no winner.

Blockchains and Game Theory

Particl takes that same military doctrine and substitutes weapons of war for financial collateral. When you buy or sell something on the Particl Marketplace, you and the other party you’re transacting with are required to lock an equal security deposit paid in PART coins in a smart contract.

Suppose one of the two parties tries to scam the other or doesn’t act in complete honesty. In that case, the “victim” can retaliate by not authorizing the bad actor’s security deposit release. This makes even just attempting to scam someone a risky business as you might lose your security deposit. In other words, a scammer cannot successfully attack another marketplace user without losing their own financial collateral.

And so, not unlike the military superpowers of this world, Particl uses the proven mathematical models behind MAD game theory to enforce honesty and accountability among its participants.

Smart contracts and Automation

A smart contract is a particular type of blockchain script. It can accomplish tasks and execute transactions autonomously following an immutable set of rules. That’s how Particl’s two-party escrow system is made autonomous and the reason no third-party is involved.

The two-party escrow smart contract is powered by a BIP-65 Bitcoin-style smart contract programmed with a set of rules pre-defined by the mathematical model of the MAD game theory. Whether a security deposit or payment is released depends on whether all the criteria for its release are met, which is that both parties mark the transaction as complete.

See also

Marketplace Explained - Particl Marketplace Explained

Marketplace Explained - Privacy Specifications

PART Guides - Send, Receive and Convert PART

Marketplace Guides - Install and Get Started